freemexy's blog

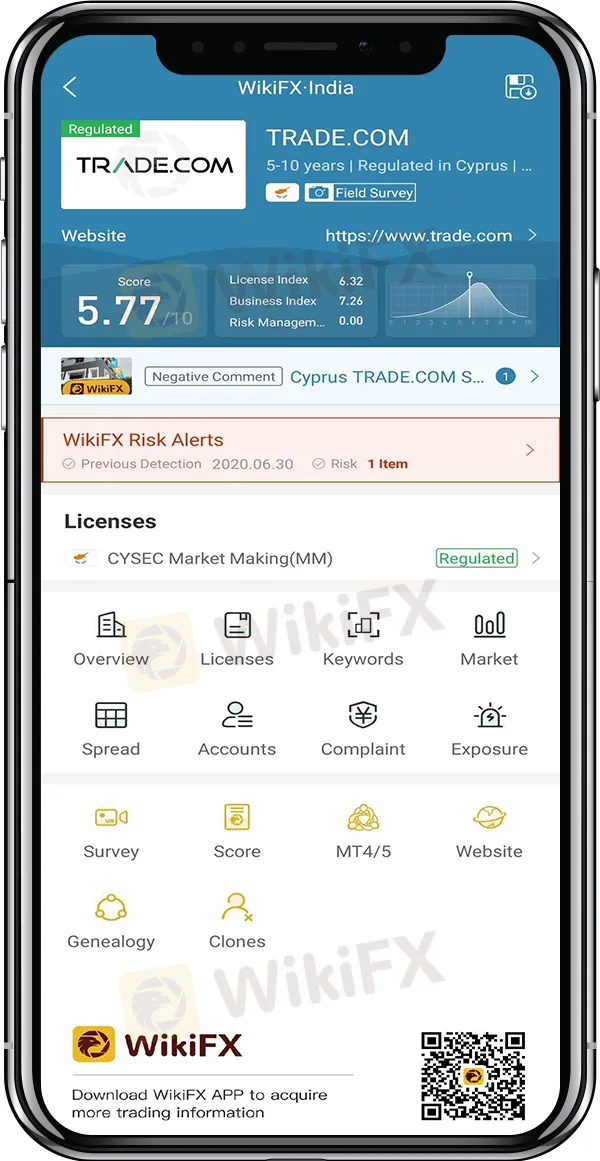

After the field investigation on TRADE.COM, WikiFX rated it as poor and warns investors against facile deposit.

One of the complainants told WikiFX that he was mildly interested in TRADE.COM at first. To begin with, he set up a virtual account on its platform for observation and more information. “I never expected the platform to be so disordered that it can screw up a virtual account.”

The above two pictures show the price trends of sweet crude oil on TRADE.COM and an authoritative platform respectively, which were both shared by the complainant. By comparison, he observed that even for the same crude oil futures, the data in the two platforms actually differs by at least 0.3 points.

The complainant said that: “The difference is large. Apparently, TRADE.COM is fixing the prices and thereby deceiving investors.” Fortunately, his account is just a virtual one, otherwise the losses may be considerable.

TRADE.COM is currently under CySEC's normal supervision. Nevertheless, WikiFX alerts investors to the risks of this broker considering the increasing complaints recently. WikiFX also reminds investors to check the authenticity of a broker‘s license, regulatory information and market data before choosing the broker. Click WikiFX APP to check broker’s qualification now.

So far, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, and protecting investors fund safety in forex trading. More exposures are coming soon.

Awaited figures on Tuesday are Japan‘s (CPI) and core CPI for June, and Canada’s retail sales and core retail sales for May.To get more news about Expert 24 Trade, you can visit wikifx news official website.

On Wednesday, the American Petroleum Institute (API) will report weekly inventory levels of crude oil and gasoline changed as of July 17. Other data out on the same day are Canada‘s CPI and core CPI for June, and Federal Housing Finance Agency’s (FHFA) house price index for May. On Thursday, Germany is going to publish its Gfk consumer confidence indicator (CCI) for August while the U.S. will release initial jobless claims and continuing claims for the week ended July 18. In the mean time, CCI for July in the euro area will be confirmed.

Gfk CCI for July in the U.K. will be focused on Friday, together with the initial value of Markit manufacturing PMI for July in France, Germany, Britain, the euro area and the United States. On the same day, the Economic and Financial Affairs Council (ECOFIN) of EU will be eyed for the budget and stimulus package discussed.

“This plainly has been a recovery and a pretty sharp one,” he told lawmakers on Parliaments Treasury Committee. “As has been the case of course globally -- in that sense we have seen a bounce-back, so far it has been a V. That does of course not tell us where we might go next.”

Haldane dissented at the BOE‘s June meeting, voting against expanding asset purchases. He’s since come across as more upbeat about the economy than Governor Andrew Bailey and fellow policy maker Silvana Tenreyro, who will also address lawmakers this afternoon.

Haldane said the economy likely hit its floor in April, and about half of the roughly 25% fall in activity in March and April has been regained. But he noted that labor market figures are “understating the unemployment problem” and policy makers are monitoring the job situation carefully.

Were “by no means out of the woods on activity or jobs, but materially better than expected two or three months ago,” he said.

BOE officials will publish updated forecasts at their next policy meeting on Aug. 6. They have been reviewing tools at their disposal, including negative interest rates, after cutting rates to a record low 0.1% and expanding their bond-buying program.

“There is plainly less room for monetary maneuver as a result of this crisis, be that interest rates or further QE,” Haldane said. “But less room for maneuver is not no monetary maneuver at all.”

Negative interest rates could potentially encourage further borrowing, though they would also have downsides like a squeeze on banks margins, he said.

Sales dropped by almost 40% to 6.62 billion euros ($7.6 billion), the German auto-parts maker said in a statement Monday. Analysts on average were expecting revenue to drop to 6.37 billion euros, according to data compiled by Bloomberg.

Although business “showed substantial improvement through the course of the second quarter,” Continental said in the statement, there is still “substantial uncertainty due to the ongoing Covid-19 pandemic.”

“It remains difficult to gauge possible adverse consequences on production, the supply chain and demand,” the company said.

Continental and its peers rushed to drastically cut costs earlier in the year when shutdowns aimed at containing the spread of the virus hit auto factories and showrooms, bringing production to a halt and significantly curbing sales. The company announced in June that it would cut its dividend payout to save about 350 million euros.

The uncertainty over how fast economies will recover is still an open question. Automotive companies are hoping government incentives will spur car sales and help the industry recover in the second half of the year.

Researchers found it triggered an immune respond to Covid-19 with only minor side effects. AstraZeneca subsequently spiked over 10 percent before retreating and closing just a little over 6.50 percent from the open.

Foreign exchange markets were somewhat mixed. The haven-linked US Dollar and anti-risk Japanese Yen and Swiss Franc along with the Euro suffered the deepest burns. Higher-beta FX like the Norwegian Krone and Swedish Krona on the other hand were sunbathing on green pasture with the British Pound. Sterling rose not so much due to GBP strength per say but rather due to weakness in its counterparts.

The Euro was left out in the cold after European Union policymakers failed to reach a consensus on what is shaping up to be the longest meeting since the 2000 summit in Nice, France. The so-called “Frugal Four” – led by Dutch Prime Minister Mark Rutte of the Netherlands and followed by Sweden, Denmark Austria and Finland – have pushed to modify the EUR750 billion aid package.

The new proposal that may be generous enough for big-spending advocates to get behind and watered-down enough for the Frugal Four to swallow reduced the amount of grants to 390 billion and increased the loan amount to 360b. The original was 500b and 250b, respectively. Until a solid agreement is reached, the Euro will likely continue to hover with a cautious upside bias. Read more about why that is here.

Tuesdays Asia-Pacific Trading Session

In addition to the politically-entangled Euro, the Australian Dollar will likely also be in the spotlight. The Reserve Bank of Australia will be releasing their meeting minutes following the interest rate decision on July 7. Officials noted that while the path ahead is uncertain, “conditions have, however, stabilised recently and the downturn has been less severe than earlier expected”.

Policymakers reinforced this notion, saying that the worst of the economic crisis may be behind as leading indicators point to signs of stabilization. Officials reiterated they are“prepared to scale-up its bond purchases” in order to achieve their employment and inflation targets. Unless the RBA significantly deviates from this message – be it more positive or negative – AUD may shrug at the comments.

Australian Dollar Analysis

After bottoming out in March, AUD/CAD has gone on to rise over 14 percent in a relatively short span of time. However, technical cues are hinting that upside momentum may be slowing with RSI showing a negative divergence. Capitulation could shatter a multi-week uptrend and open the door to retesting stubborn support at 0.9293. Follow me on Twitter @ZabelinDimitri for more timely technical updates.

A 19-year-old Lenawee County man’s future is looking bright after he won $1 million playing the Michigan Lottery’s Millionaire Maker instant game.Get more news about 彩票包网平台,you can vist loto98.com

The player, who chose to remain anonymous, bought his winning ticket at the Lowry Grocery Store, located at 932 East Beecher Street in Adrian.

“I scratched the ticket in the store and I just couldn’t believe what I was seeing,” said the player. “I must have called my mom 90 times before I got through to her and then she wouldn’t believe me. My family thought I was joking until they saw the ticket for themselves!”

The player visited Lottery headquarters to claim the big prize. He chose to receive his prize as a one-time lump sum payment of about $634,000, rather than annuity payments for the full amount. He plans to invest his winnings.

Players have won more than $62 million playing Millionaire Maker, which launched in April 2019. Each $20 ticket offers players a chance to win prizes ranging from $40 up to $1 million. More than $36 million in prizes remain, including four $1 million top prizes and 11 $5,000 prizes.

Check your tickets. One lucky person is the winner of the $124 million Mega Millions jackpot from Friday’s drawing sold in Bayonne.Get more news about 彩票包网,you can vist loto98.com

The ticket matched all five of the white ball numbers 08, 33, 39, 54, and 58, and the gold Mega ball 17. Brenda’s Inc. on 110 Kennedy Blvd. in Bayonne sold the winning ticket.

The winner of the jackpot ticket has one year to claim the prize, according to the New Jersey Lottery’s website.

The last jackpot Mega Millions lottery ticket was sold in June winning $410 million.

The next drawing for the Mega Million lottery will be held on Tuesday for a jackpot of $20 million.

Geely Automobile Holdings raised $836 million from a share placement as the Chinese automaker looks to replenish coffers to finance growth in the world’s largest auto market.To get more news about Geely news, you can visit shine news official website.

Hong Kong-based Geely has sold 600 million primary shares at the bottom of the $1.39-$1.44 price range, or at a 7.85 percent discount to the last closing price of HK$11.72, according to a release.

The offering represents about 6.1 percent of its enlarged share capital, and the company plans to use the proceeds to support business development and general growth.

The share placement comes after China’s economy contracted 6.8 percent in the first quarter, as the country reels from an epidemic that started in the central city of Wuhan.

Geely Automobile, based in the eastern province of Zhejiang, is China’s most globally high-profile automaker following investments by parent company Zhejiang Geely Holding Group in European manufacturers Volvo Car and Daimler AG.

Geely Automobile and Volvo – which Geely’s parent bought from Ford Motor Co. in 2010 – are planning to merge and list in Hong Kong and possibly Stockholm.

“This plan is essential,” said interim boss Clotilde Delbos, who announced a bigger focus on electric cars and vans.Some 4,600 jobs will go in France, and Renault has said six plants are under review for possible cuts and closure.Renault played down reports it could move some production to the UK plant run by its strategic partner Nissan.To get more news about Renault news, you can visit shine news official website.

“You shouldn’t believe everything you read in the newspapers,” Ms Delbos said. “All you’ve seen in the newspapers are but rumours.”On Thursday, Nissan unveiled huge job cuts and the closure of its factory in Barcelona. The UK plant, in Sunderland, would remain open, the Japanese company said.

Renault, 15% owned by the French state and which is in talks with the

government about an €8bn loan, has begun negotiations with unions about

which factories could shut.The company is slashing costs by cutting the

number of subcontractors in areas such as engineering, reducing the

number of components it uses, freezing expansion plans in Romania and

Morocco and shrinking gearbox manufacturing worldwide.The French firm

plans to trim its global production capacity to 3.3 million vehicles in

2024 from 4 million now, focusing on areas like small vans or electric

cars.

Renault is part of a three-way alliance with Nissan and Mitsubishi. On

Thursday, Nissan said it would close its factory in Barcelona with the

loss of about 2,800 jobs in a bid to cut costs, prompting protests at

the Spanish plant.

Cost-cutting measures announced by both Renault and Nissan mark a departure from the ambitious expansion plan devised by now-ousted leader of the alliance, Carlos Ghosn.Renault’s interim chief executive Ms Delbos said during a press conference on Friday: “We have to change our mindset.

“We’re not looking to be on top of the world, what we want is a sustainable and profitable company.”Renault, which claims more than 4% of the global car market, said its plans would affect about 10% of its 179,000-strong global workforce and cost up to €1.2bn (£1.1bn).

Ms Delbos added that Renault would review each region in order to decide where job cuts will fall. “This will help us come back to our ideal size,” she said.Both Nissan and Renault were already facing falling sales before the Covid-19 outbreak worsened trading.

Renault’s sales were down 3% last year and the number of vehicles sold in the first three months of 2020 fell by 25%, before dropping further in April.The struggling firm is currently in talks with the French government over a €5bn emergency loan package.

The French government has also pledged €8bn in wider rescue funds aimed at shoring up the country’s car industry. In exchange, President Emmanuel Macron had said Renault should keep workers and production in the country.

At BlizzCon 2019, Blizzard announced Torghast, Tower of the Damned as one of World of Warcraft: Shadowlands’ brand-new endgame features. It’s now available for testing in the Shadowlands alpha. Here’s how it works, and the rewards you can earn by competing.To get more news about cheap WoW Items, you can visit lootwowgold news official website.

Blizzard said last week that Torghast was inspired by roguelikes — games like Hades and Dead Cells, where each failed run rewards you with knowledge and skill that aid in your next attempt. Unlike a traditional World of Warcraft dungeon, Torghast has fixed levels with procedurally generated enemy spawns. The floors start simple, and eventually evolve into elaborate wings with traps, locked doors, and puzzles.

But getting through Torghast takes more than your usual skills. As you climb the tower, you can find Anima Powers. These abilities only function in Torghast for your current run, and can fundamentally change your play style. You can also collect a new resource called Phantasma, which you can spend at the Shackled Broker for items or new Anima Powers.The Anima Powers themselves affect all kinds of things. One may increase your movement speed, while another could buff a stat. But depending on the Covenant you’ve devoted yourself to, you’ll have access to different types of Anima Powers. Each class also has unique ones to choose from.

You can find Anima Powers by completing bonus objectives, discovering them hidden in levels, and many other ways. You can check out the full list of powers on WoWHead.

Unlike World of Warcraft’s other endgame dungeon activity, Mythic+ dungeons, Torghast is not timed. Instead, you have a limited number of lives before your run comes to an end. Once you’ve died a certain number of times, a giant, unkillable boss called the Tarragrue will spawn at the entrance to your current floor, and will slowly lumber toward the exit. If the Tarragrue spots you, it’ll chase you down and kill you in a single strike. But if you can reach the end of the current floor before the Tarragrue does, you’ll escape to the next floor.Successfully climbing up Torghast’s floors will eventually net you a Legendary chest. Here you can pick up powerful materials to take out of Torghast and craft powerful gear of your choice.

In an interview with Twitch streamer Towelliee, senior game designer Paul Kubit revealed some additional details around how Torghast will actually work in Shadowlands. Players will need to grind keys to access Torghast, and rewards won’t be as frequent after you’ve already collected a set amount during a week.

The goal of the dungeon isn’t to offer you gear to equip, but quests to complete and materials to craft your own gear. According to Kubit, you may also run into some well-known World of Warcraft souls on these quests.

Torghast is an important part of the Shadowlands endgame, and something you should be able to access shortly after reaching the max level. Kubit also told Towelliee that Torghast will remain a key feature in Shadowlands, and that the team plans to add new floors and features as the expansion ages.