freemexy's blog

A Simple guide for new Investors to the surge in Gold prices

Gold

prices hit a record at the end of last week, creating a new milestone

in a surge that began in late 2018 and has gathered momentum during the

coronavirus pandemic.To get more news about WikiFX, you can visit wikifx news official website.

Gold soared roughly 30% in 2020 to stop just short of closing at

$2,000 a troy ounce—which is an all-time high in New York trading as it

surpassed the Nasdaq Composite Index of highflying technology stocks.

What is the gold market?

There are two gold markets, remarkably similar because investment banks and other big players are active in both.

The first is the physical market, which brings together miners,

refiners, jewellers, central banks, electronics manufacturers, banks and

investors.

London is the focal point, dating back to the first

gold rush from Brazil in 1697. Shanghai, Zurich, Dubai and Hong Kong are

also hubs.

In good times, gold costs roughly the same amount in London‘s physical market and on New York’s Comex.

If prices move out of kilter, banks bring them back in line by buying

bullion on the cheap in one city, flying it across the Atlantic

(normally in the cargo hold of a passenger plane) and selling at a

profit where prices are higher.

They must factor in the small sum

it costs to recast the gold, since Comex requires smaller bars, weighing

either 100 troy ounces or a kilo.

The Corona virus pandemic

scrambled this self-correcting mechanism in March this year. The world

is still reeling from the effects.

Flights not operating due to

the pandemic led to fears of a shortage in New York, sending futures

well above spot prices in London.

The concerns proved unfounded, but the violent price moves led to losses at banks including HSBC Holdings PLC.

That has prompted banks to trade less actively on the Comex, which could make futures more volatile going forward.

How do Investors buy and sell gold?

Professional fund managers bet on gold prices with futures.

To avoid taking hold of a large amount of bullion, investors normally

sell futures before they expire and buy later-dated contracts, a

process known as rolling.

This comes at a cost because longer-dated futures cost more than spot gold.

The difference normally goes to the pockets of the investors enemy —

investment bankers—who gets to buy at the low prices and sell at high

prices.

Regular investors, comprising of Parents, Everyday people

buy physical bars and coins, which they can either keep at home or in

vaults.

Demand for bars and coins has shot up during the pandemic, though clients are also selling to profit on rising prices.

When things go bonkers and out of hand, with a lot of uncertainty in

the markets, the two precious metal all investors rush to are gold and

silver. A lot of investors consider it a safe haven investment.

Investors who want exposure to gold prices without the hassle of

storing bullion or trading futures found an alternate solution in 2003:

exchange-traded funds (ETFs).

These funds, with a huge surge in popularity, buy gold and issue shares that trade on the stock exchange.

The Best PvE Elemental Shaman Build for WoW Classic

As a hybrid class, Shamans combine the traits of DPSers, Healers and, to a lesser extent, Tanks. Thanks to this, they are among the most universal characters in WoW Classic. Elemental Shamans take full advantage of what their Class provides which makes them arguably the best Support DPS specialization in the game. For one, they can equip shields and mail, leather or cloth armor, which makes them flexible when it comes to equipment. On top of that, they can deploy a Class-specific themed group of ground-based buffs called Totems. With these, they can provide various powerful damage-increasing buffs (Windfury Totem, Grace of Air Totem, and Strength of Earth Totem), assist their group by providing very strong utility (Poison Cleansing Totem, Tremor Totem), or help with group's sustain and longevity (Stoneskin Totem, Windwall Totem, Mana Spring Totem). Moreover, they have: the best interrupt in the game in the form of the Earth Shock (its cooldown is just 6 seconds which is the shortest of all interrupts), an ability to Purge Targets which removes magic effects from them, and the Frost Shock which is infamous for being able to perma-slow a Target (Frost Shock's slow effect is longer than its cooldown). On top of that, they have powerful PvE DPS-oriented tools, like Elemental Mastery and Elemental Focus, that let them deal sustained Damage and burst down their Targets quickly if needed.To get more news about Buy WoW Items, you can visit lootwowgold news official website.

Thanks to the utility that they provide, every group will benefit from having an Elemental Shaman in it. This fact combined with Shaman's versatility makes Elementals an inherent part of almost every Horde Raid.Note: Here, we will point you only towards the best PvE Elemental Shaman Race. If you'd like to know more about other race picks, please check our WoW Classic Beginners Guide, where we dive deep into all available Shaman races.

There is only one profession that makes a real impact in Raids and it is Engineering. It gives you access to powerful explosives that increase your AoE and Single-Target DPS. Thrown explosives have a decent range, so you can use them effectively while sticking with Ranged groups of your Raid and providing them with Totem buffs. The fact that Engineering is also considered the best PvP profession is an added benefit to its power in the PvE environment. Alchemy is the second interesting option. It will let you brew a lot of much-needed Consumables and when paired with Herbalism, allow you to make a nice profit on the Auction House (this is a less competitive option as most of the Consumables that come from Alchemy can be bought from other players rather cheaply).

At the start, you should pick Mining to supplement your Engineering Skill, you can always switch it to another profession of your liking later on. If you've decided to go for Alchemy, Herbalism is the natural second profession pick - we recommend you stick with it for as long as you actively use Alchemy.

WoW Classic player reaches max level by only killing boars

YouTuber Dr Five has managed what was once just the stuff of South Park. He’s reached max level on a character in World of Warcraft Classic just by completing one task: killing boars.To get more news about WoW Classic Gold, you can visit lootwowgold news official website.

The stunt is a reference to one of the best-remembered South Park episodes, “Make Love, Not Warcraft,” where the children have all recently gotten into playing World of Warcraft. Unfortunately for them, their game is constantly interrupted by a griefer, a high-ranking player who keeps killing their characters and won’t leave them alone. The children decide to take on the griefer, but they need to power up their characters first. To do this, they stay in Elwynn Forest, one of World of Warcraft‘s starting zones, and kill an endless number of low-level boars. The process takes ages, and the children go through a remarkable physical degradation as they spend months sitting in one place, performing the same meaningless task over and over again.

By leveling a character from 1-60 by only killing boars, Dr Five has managed to complete the same challenge — though the task fortunately did not take the same extreme physical toll on his body.

Despite the

obvious commentary, the episode has become extremely popular with World

of Warcraft players. At BlizzCon 2013, Jarod Lee Nandin first cosplayed

the griefer, complete with computer and desk — a cosplay that he’s only

added to over the years.

While it’s impossible to use this

boar-killing method to reach max level in current World of Warcraft, as

creatures stop granting XP after a certain level, it has remained

technically possible in Classic. Honestly, someone would have done it

sooner or later; it was only a matter of time. Speaking of time, it took

Dr Five nine days and 18 hours of in-game time. He killed over 10,000

boars.

In World of Warcraft Classic, there are 71 Mounts, consisting of: 34 Alliance Mounts and 27 Horde Mounts. WOW Classic Mounts take roles of transportation, which can increase your movement speed by a certain amount and are used for traveling around most zones. World of Warcraft Classic Mounts can have either Rare or Epic qualities, which have different movement speeds, are usable at different levels.To get more news about WoW Gold Classic, you can visit lootwowgold news official website.

First of all, there is the easiest way for you to get mounts; you can get them by purchasing. Here, you can find all kinds of unarmored epic mounts, including Black Ram, Frost Ram, Icy Blue Mechanostrider Mod A, White Stallion Bridle, Reins of the Frostsaber and so on. What’s more, we offer the cheapest price, safe & fast delivery and 100% safe insurance. Buy Cheap WOW Classic Mounts now, and enjoy the lowest price ever.

Secondly, there are four classes in the game that can acquire special mounts and abilities linked to their own class through lore: death knights, druids, paladins, and warlocks. The original quests to gain the paladin charger, warlock dreadsteed, and druid’s swift flight form are all still in-game and reward feats of strength if they are completed.

Thirdly, each race has a type of ground mount just for them, which are available in a variety of colors and styles. But if you want a different race’s mount, be aware that you can buy mounts of other races in your faction once you’ve hit exalted with that race. (Note: Since all mounts are account-wide, if you want another race’s mount, you may find it easier to roll an alt of that race and level them to 20 to pick up the mount you’re after. But Alliance still can’t get Horde mounts and vice versa.)

In Classic, obtaining your mount at level 40 and when you reach (or hopefully soon after) level 60 is a huge landmark for your character. After obtaining your level 40 mount, you will be able to move from place to place more quickly, shortening your leveling time. Obtaining your epic level 60 mount will allow you to arrive on time to raids with the rest of the group, and you will be much more likely to be accepted into PvP pre-made groups. Depending on the competitiveness and timeline of the server, an epic mount can be a requirement for this. In addition to these benefits, a mount, especially an epic mount, is a huge status symbol in the game.

Getting a mount is tough and is why it is such a landmark point for your character. There is another way, you need enough WOW Classic Gold to pay your mounts, but learning how to farm gold is also an important and long lesson for you.

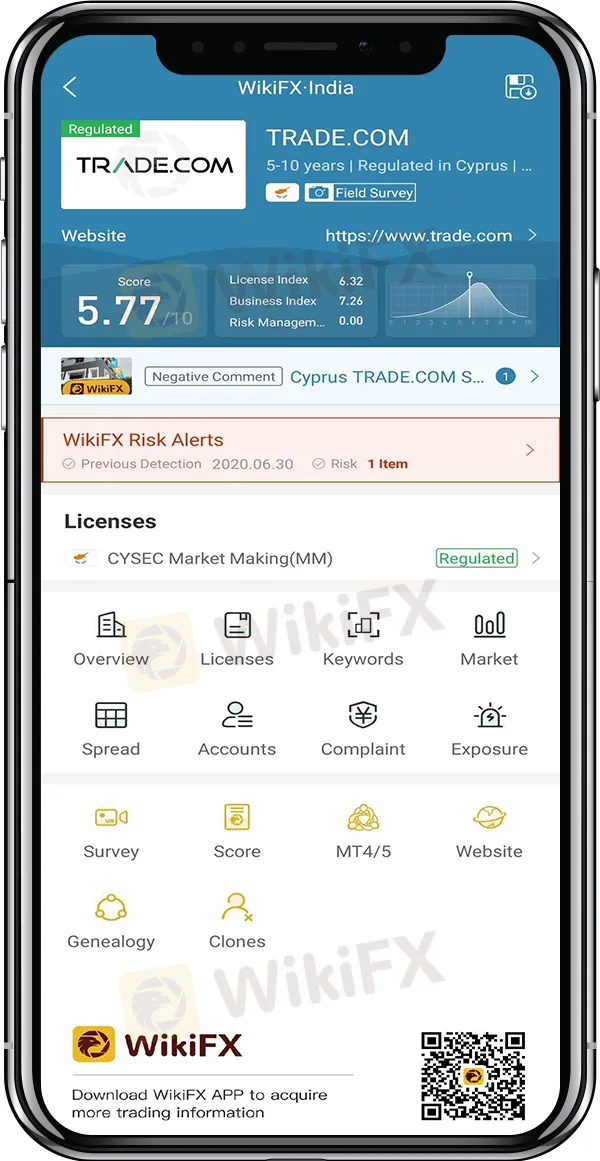

After the field investigation on TRADE.COM, WikiFX rated it as poor and warns investors against facile deposit.

One of the complainants told WikiFX that he was mildly interested in TRADE.COM at first. To begin with, he set up a virtual account on its platform for observation and more information. “I never expected the platform to be so disordered that it can screw up a virtual account.”

The above two pictures show the price trends of sweet crude oil on TRADE.COM and an authoritative platform respectively, which were both shared by the complainant. By comparison, he observed that even for the same crude oil futures, the data in the two platforms actually differs by at least 0.3 points.

The complainant said that: “The difference is large. Apparently, TRADE.COM is fixing the prices and thereby deceiving investors.” Fortunately, his account is just a virtual one, otherwise the losses may be considerable.

TRADE.COM is currently under CySEC's normal supervision. Nevertheless, WikiFX alerts investors to the risks of this broker considering the increasing complaints recently. WikiFX also reminds investors to check the authenticity of a broker‘s license, regulatory information and market data before choosing the broker. Click WikiFX APP to check broker’s qualification now.

So far, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, and protecting investors fund safety in forex trading. More exposures are coming soon.

Awaited figures on Tuesday are Japan‘s (CPI) and core CPI for June, and Canada’s retail sales and core retail sales for May.To get more news about Expert 24 Trade, you can visit wikifx news official website.

On Wednesday, the American Petroleum Institute (API) will report weekly inventory levels of crude oil and gasoline changed as of July 17. Other data out on the same day are Canada‘s CPI and core CPI for June, and Federal Housing Finance Agency’s (FHFA) house price index for May. On Thursday, Germany is going to publish its Gfk consumer confidence indicator (CCI) for August while the U.S. will release initial jobless claims and continuing claims for the week ended July 18. In the mean time, CCI for July in the euro area will be confirmed.

Gfk CCI for July in the U.K. will be focused on Friday, together with the initial value of Markit manufacturing PMI for July in France, Germany, Britain, the euro area and the United States. On the same day, the Economic and Financial Affairs Council (ECOFIN) of EU will be eyed for the budget and stimulus package discussed.

“This plainly has been a recovery and a pretty sharp one,” he told lawmakers on Parliaments Treasury Committee. “As has been the case of course globally -- in that sense we have seen a bounce-back, so far it has been a V. That does of course not tell us where we might go next.”

Haldane dissented at the BOE‘s June meeting, voting against expanding asset purchases. He’s since come across as more upbeat about the economy than Governor Andrew Bailey and fellow policy maker Silvana Tenreyro, who will also address lawmakers this afternoon.

Haldane said the economy likely hit its floor in April, and about half of the roughly 25% fall in activity in March and April has been regained. But he noted that labor market figures are “understating the unemployment problem” and policy makers are monitoring the job situation carefully.

Were “by no means out of the woods on activity or jobs, but materially better than expected two or three months ago,” he said.

BOE officials will publish updated forecasts at their next policy meeting on Aug. 6. They have been reviewing tools at their disposal, including negative interest rates, after cutting rates to a record low 0.1% and expanding their bond-buying program.

“There is plainly less room for monetary maneuver as a result of this crisis, be that interest rates or further QE,” Haldane said. “But less room for maneuver is not no monetary maneuver at all.”

Negative interest rates could potentially encourage further borrowing, though they would also have downsides like a squeeze on banks margins, he said.

Sales dropped by almost 40% to 6.62 billion euros ($7.6 billion), the German auto-parts maker said in a statement Monday. Analysts on average were expecting revenue to drop to 6.37 billion euros, according to data compiled by Bloomberg.

Although business “showed substantial improvement through the course of the second quarter,” Continental said in the statement, there is still “substantial uncertainty due to the ongoing Covid-19 pandemic.”

“It remains difficult to gauge possible adverse consequences on production, the supply chain and demand,” the company said.

Continental and its peers rushed to drastically cut costs earlier in the year when shutdowns aimed at containing the spread of the virus hit auto factories and showrooms, bringing production to a halt and significantly curbing sales. The company announced in June that it would cut its dividend payout to save about 350 million euros.

The uncertainty over how fast economies will recover is still an open question. Automotive companies are hoping government incentives will spur car sales and help the industry recover in the second half of the year.

Researchers found it triggered an immune respond to Covid-19 with only minor side effects. AstraZeneca subsequently spiked over 10 percent before retreating and closing just a little over 6.50 percent from the open.

Foreign exchange markets were somewhat mixed. The haven-linked US Dollar and anti-risk Japanese Yen and Swiss Franc along with the Euro suffered the deepest burns. Higher-beta FX like the Norwegian Krone and Swedish Krona on the other hand were sunbathing on green pasture with the British Pound. Sterling rose not so much due to GBP strength per say but rather due to weakness in its counterparts.

The Euro was left out in the cold after European Union policymakers failed to reach a consensus on what is shaping up to be the longest meeting since the 2000 summit in Nice, France. The so-called “Frugal Four” – led by Dutch Prime Minister Mark Rutte of the Netherlands and followed by Sweden, Denmark Austria and Finland – have pushed to modify the EUR750 billion aid package.

The new proposal that may be generous enough for big-spending advocates to get behind and watered-down enough for the Frugal Four to swallow reduced the amount of grants to 390 billion and increased the loan amount to 360b. The original was 500b and 250b, respectively. Until a solid agreement is reached, the Euro will likely continue to hover with a cautious upside bias. Read more about why that is here.

Tuesdays Asia-Pacific Trading Session

In addition to the politically-entangled Euro, the Australian Dollar will likely also be in the spotlight. The Reserve Bank of Australia will be releasing their meeting minutes following the interest rate decision on July 7. Officials noted that while the path ahead is uncertain, “conditions have, however, stabilised recently and the downturn has been less severe than earlier expected”.

Policymakers reinforced this notion, saying that the worst of the economic crisis may be behind as leading indicators point to signs of stabilization. Officials reiterated they are“prepared to scale-up its bond purchases” in order to achieve their employment and inflation targets. Unless the RBA significantly deviates from this message – be it more positive or negative – AUD may shrug at the comments.

Australian Dollar Analysis

After bottoming out in March, AUD/CAD has gone on to rise over 14 percent in a relatively short span of time. However, technical cues are hinting that upside momentum may be slowing with RSI showing a negative divergence. Capitulation could shatter a multi-week uptrend and open the door to retesting stubborn support at 0.9293. Follow me on Twitter @ZabelinDimitri for more timely technical updates.

A 19-year-old Lenawee County man’s future is looking bright after he won $1 million playing the Michigan Lottery’s Millionaire Maker instant game.Get more news about 彩票包网平台,you can vist loto98.com

The player, who chose to remain anonymous, bought his winning ticket at the Lowry Grocery Store, located at 932 East Beecher Street in Adrian.

“I scratched the ticket in the store and I just couldn’t believe what I was seeing,” said the player. “I must have called my mom 90 times before I got through to her and then she wouldn’t believe me. My family thought I was joking until they saw the ticket for themselves!”

The player visited Lottery headquarters to claim the big prize. He chose to receive his prize as a one-time lump sum payment of about $634,000, rather than annuity payments for the full amount. He plans to invest his winnings.

Players have won more than $62 million playing Millionaire Maker, which launched in April 2019. Each $20 ticket offers players a chance to win prizes ranging from $40 up to $1 million. More than $36 million in prizes remain, including four $1 million top prizes and 11 $5,000 prizes.