freemexy's blog

Check your tickets. One lucky person is the winner of the $124 million Mega Millions jackpot from Friday’s drawing sold in Bayonne.Get more news about 彩票包网,you can vist loto98.com

The ticket matched all five of the white ball numbers 08, 33, 39, 54, and 58, and the gold Mega ball 17. Brenda’s Inc. on 110 Kennedy Blvd. in Bayonne sold the winning ticket.

The winner of the jackpot ticket has one year to claim the prize, according to the New Jersey Lottery’s website.

The last jackpot Mega Millions lottery ticket was sold in June winning $410 million.

The next drawing for the Mega Million lottery will be held on Tuesday for a jackpot of $20 million.

Geely Automobile Holdings raised $836 million from a share placement as the Chinese automaker looks to replenish coffers to finance growth in the world’s largest auto market.To get more news about Geely news, you can visit shine news official website.

Hong Kong-based Geely has sold 600 million primary shares at the bottom of the $1.39-$1.44 price range, or at a 7.85 percent discount to the last closing price of HK$11.72, according to a release.

The offering represents about 6.1 percent of its enlarged share capital, and the company plans to use the proceeds to support business development and general growth.

The share placement comes after China’s economy contracted 6.8 percent in the first quarter, as the country reels from an epidemic that started in the central city of Wuhan.

Geely Automobile, based in the eastern province of Zhejiang, is China’s most globally high-profile automaker following investments by parent company Zhejiang Geely Holding Group in European manufacturers Volvo Car and Daimler AG.

Geely Automobile and Volvo – which Geely’s parent bought from Ford Motor Co. in 2010 – are planning to merge and list in Hong Kong and possibly Stockholm.

“This plan is essential,” said interim boss Clotilde Delbos, who announced a bigger focus on electric cars and vans.Some 4,600 jobs will go in France, and Renault has said six plants are under review for possible cuts and closure.Renault played down reports it could move some production to the UK plant run by its strategic partner Nissan.To get more news about Renault news, you can visit shine news official website.

“You shouldn’t believe everything you read in the newspapers,” Ms Delbos said. “All you’ve seen in the newspapers are but rumours.”On Thursday, Nissan unveiled huge job cuts and the closure of its factory in Barcelona. The UK plant, in Sunderland, would remain open, the Japanese company said.

Renault, 15% owned by the French state and which is in talks with the

government about an €8bn loan, has begun negotiations with unions about

which factories could shut.The company is slashing costs by cutting the

number of subcontractors in areas such as engineering, reducing the

number of components it uses, freezing expansion plans in Romania and

Morocco and shrinking gearbox manufacturing worldwide.The French firm

plans to trim its global production capacity to 3.3 million vehicles in

2024 from 4 million now, focusing on areas like small vans or electric

cars.

Renault is part of a three-way alliance with Nissan and Mitsubishi. On

Thursday, Nissan said it would close its factory in Barcelona with the

loss of about 2,800 jobs in a bid to cut costs, prompting protests at

the Spanish plant.

Cost-cutting measures announced by both Renault and Nissan mark a departure from the ambitious expansion plan devised by now-ousted leader of the alliance, Carlos Ghosn.Renault’s interim chief executive Ms Delbos said during a press conference on Friday: “We have to change our mindset.

“We’re not looking to be on top of the world, what we want is a sustainable and profitable company.”Renault, which claims more than 4% of the global car market, said its plans would affect about 10% of its 179,000-strong global workforce and cost up to €1.2bn (£1.1bn).

Ms Delbos added that Renault would review each region in order to decide where job cuts will fall. “This will help us come back to our ideal size,” she said.Both Nissan and Renault were already facing falling sales before the Covid-19 outbreak worsened trading.

Renault’s sales were down 3% last year and the number of vehicles sold in the first three months of 2020 fell by 25%, before dropping further in April.The struggling firm is currently in talks with the French government over a €5bn emergency loan package.

The French government has also pledged €8bn in wider rescue funds aimed at shoring up the country’s car industry. In exchange, President Emmanuel Macron had said Renault should keep workers and production in the country.

At BlizzCon 2019, Blizzard announced Torghast, Tower of the Damned as one of World of Warcraft: Shadowlands’ brand-new endgame features. It’s now available for testing in the Shadowlands alpha. Here’s how it works, and the rewards you can earn by competing.To get more news about cheap WoW Items, you can visit lootwowgold news official website.

Blizzard said last week that Torghast was inspired by roguelikes — games like Hades and Dead Cells, where each failed run rewards you with knowledge and skill that aid in your next attempt. Unlike a traditional World of Warcraft dungeon, Torghast has fixed levels with procedurally generated enemy spawns. The floors start simple, and eventually evolve into elaborate wings with traps, locked doors, and puzzles.

But getting through Torghast takes more than your usual skills. As you climb the tower, you can find Anima Powers. These abilities only function in Torghast for your current run, and can fundamentally change your play style. You can also collect a new resource called Phantasma, which you can spend at the Shackled Broker for items or new Anima Powers.The Anima Powers themselves affect all kinds of things. One may increase your movement speed, while another could buff a stat. But depending on the Covenant you’ve devoted yourself to, you’ll have access to different types of Anima Powers. Each class also has unique ones to choose from.

You can find Anima Powers by completing bonus objectives, discovering them hidden in levels, and many other ways. You can check out the full list of powers on WoWHead.

Unlike World of Warcraft’s other endgame dungeon activity, Mythic+ dungeons, Torghast is not timed. Instead, you have a limited number of lives before your run comes to an end. Once you’ve died a certain number of times, a giant, unkillable boss called the Tarragrue will spawn at the entrance to your current floor, and will slowly lumber toward the exit. If the Tarragrue spots you, it’ll chase you down and kill you in a single strike. But if you can reach the end of the current floor before the Tarragrue does, you’ll escape to the next floor.Successfully climbing up Torghast’s floors will eventually net you a Legendary chest. Here you can pick up powerful materials to take out of Torghast and craft powerful gear of your choice.

In an interview with Twitch streamer Towelliee, senior game designer Paul Kubit revealed some additional details around how Torghast will actually work in Shadowlands. Players will need to grind keys to access Torghast, and rewards won’t be as frequent after you’ve already collected a set amount during a week.

The goal of the dungeon isn’t to offer you gear to equip, but quests to complete and materials to craft your own gear. According to Kubit, you may also run into some well-known World of Warcraft souls on these quests.

Torghast is an important part of the Shadowlands endgame, and something you should be able to access shortly after reaching the max level. Kubit also told Towelliee that Torghast will remain a key feature in Shadowlands, and that the team plans to add new floors and features as the expansion ages.

Blizzard released patch 8.0 for World of Warcraft 25 days ago, effectively signaling the beginning of the next expansion, Battle for Azeroth. It’s an exciting update full of changes both big and small, but 8.0 also heralds the end of Legion, the best expansion since 2008′s Wrath of the Lich King. Now that it’s over, I can’t help but feel sad. It’s been a great two years of World of Warcraft’s now 13-year-old life. Not many games this old get better with age, but Legion is bound to be an expansion people fondly remember for years to come.To get more news about Buy WoW Classic Gold, you can visit lootwowgold news official website.

And it’s easy to see why. After what basically amounted to a mid-life crisis with Cataclysm and Warlords of Draenor, World of Warcraft has settled into confident maturity—a bold vision that pays homage to the past while not being chained to it. Legion made World of Warcraft more accessible than ever before while also nailing a cadence of updates and dynamic content that made sure I always had a reason to log in. After years of worrying if World of Warcraft’s best years is behind it, Legion is a strong argument otherwise.

To the Broken Isles

Legion, Warcraft’s sixth expansion, launched almost two years ago on

August 30, 2016. When I first reviewed it back then, I said it bore “a

terrible weight” by having to make up for the flop that was Warlords of

Draenor. While Warlords of Draenor started off promising, its core

features isolated players into singleplayer instances of the world and

meaningful updates were too few and far between. Soon after, Blizzard

revealed that World of Warcraft had shed over 3 million subscribers

since Warlords’ launch. There just wasn’t much reason to play. While

World of Warcraft was still easily the most popular MMO with over 6

million subscribers, it wasn’t very promising news for the future of the

game. And Legion would have to be the expansion that turned these ill

omens around.

When Blizzard first announced Legion at Gamescom 2015, fans were

concerned that it might be a rushed expansion to shore up the ongoing

discontent with Warlords of Draenor. But when Blizzard did an in-depth

reveal a few months later at Blizzcon, it was already clear that Legion

wasn’t repeating Warcraft’s past mistakes. Instead, Blizzard wanted to

give players everything they been asking for since The Burning Crusade

launched in 2006.

Gone were the singleplayer Garrisons, for example, that confined players

to their own little base whenever they weren’t out questing. Instead,

Legion would introduce class-specific Order Halls where everyone of that

same class would hang out to pick up new story quests, assign duties to

NPC followers, and power up new artifact weapons. And Demon Hunters

finally became a playable class—one of the best that Blizzard has ever

designed. Not only are they great in combat (I particularly love how

indomitable the tanky Vengeance specialization feels), but their ability

to fly and overall mobility made World of Warcraft feel kinetic in a

way it never had before. I managed a Demon Hunter throughout the

entirety of Legion and loved it.

When I first played Legion, I found one of World of Warcraft’s most

exquisitely detailed and designed zones to date. The Broken Isles was a

Greatest Hits of World of Warcraft lore, with each zone pulling

inspiration from a beloved corner of Azeroth. Val’Sharah was a rich

woodland slowly succumbing to a festering rot, while Asuna was a

melancholy elven ruin. Each of the five zones was so distinct it felt a

bit silly going from one to the next but they also exemplified how good

Blizzard is at world building. One subtle yet major improvement was with

level-scaling, which has now been applied to all of the old ones too.

In Legion, each of the four leveling zones could be tackled in whatever

order you wanted and monsters would always scale to your level to keep

things challenging.

Legion also improved and iterated on Warlords of Draenor’s already great quest design. Treasures, elite monsters, and easter eggs were scattered everywhere, encouraging me to take countless detours to my next objective. And the quests themselves varied greatly and told interesting stories that helped deepen my understanding of the world and its inhabitants. I particularly loved Suramar, the endgame zone restricted for characters at level 110. This elven city was a huge step forward in how Blizzard designed urban areas. Each district was buzzing with activity and interesting things to see and do. The overarching story of the exiled Nightborne starting a revolution in Suramar that was told over the course of two updates was fun despite, at times, feeling like a grind.

While I’d still like to see Battle for Azeroth improve on this, Legion felt more social thanks to public Order Halls and new World Quests. Once players reached the level cap of 110, World Quests would dynamically spawn all over the Broken Isles that offered all kinds of loot. It encouraged players to get out there and exist in the world instead of hiding in Dalaran waiting to get into pre-matched dungeons and raids. It meant the world itself was constantly full of players to team up with and (if the mood struck me) gank.

Blizzard has confirmed that a small change has been made to the launch of the WoW Classic War Effort today but that server downtime shouldn’t delay players for long.The latest news on today’s launch reads: “As some have noticed, we have Breaking News in the Battle.net App for WoW Classic that indicates a two-hour downtime for the content update along with the weekly raid reset tomorrow.To get more news about Buy WoW Gold, you can visit lootwowgold news official website.

“We’re changing that to 30 minutes. We do need to make sure realms are down when the reset occurs, and we expect to finish our final checks for the content and see realms open to players at around (5:30PM BST) 9:30 a.m. PDT / 12:30 p.m. EDT.”

ORIGINAL: Plenty of stuff is happening this week, if you’re a fan of WoW Classic and are ready to experience the release of the new Phase 5 content.The good news is that we know exactly when things will be kicking off connected to the WoW Classic War Effort and how long gamers will have to wait until they can start the next part.As you might expect, it will take a while for everything to unlock and the new Ahn’Qiraj raid can be unlocked.

From what has been shared so far, the WoW Classic Phase 5 release date has been set for July 28, 2020, across all servers. This will be the time that the server-wide event will start kicking off and the War Effort can begin.Blizzard has confirmed that the start time for the War Effort has been set for 5pm BST, or 9am PT, if you live in the United States.The dev team has confirmed that this will occur with the weekly raid reset in each region, because the content involves Blackwing Lair.

A new message from Blizzard explaining its schedule for the upcoming WoW Classic launch adds:“This is the time when the War Effort will begin and each faction can turn in immense amounts of supplies that, once completed, will require five days to be transported to Silithus.

“The initial War Effort requires a great deal of supplies to be turned in by your faction on your realm. If this is not complete 30 days after the content is unlocked, small amounts of supplies will begin turning in automatically, as they did in the version 1.12 of original WoW.

“The gates still require somebody to “Bang a Gong!”, but this will help ensure that all realms have the chance to unlock Ahn’Qiraj before Naxxramas is released.Due to the raid requirements in the quest chain leading up to the “Bang A Gong!” quest, the earliest that the gong-ringing can occur in Silithus on highly-motivated realms will be just over a week later.

“Once the gong is rung on a realm, the 10 Hour War begins. Once the 10 hours has elapsed, “Bang a Gong!” can never be turned in anymore, the two Ahn’Qiraj raids will open, and the “Treasures of the Timeless One” quest will become available.

“During the 10 Hour War, world bosses do not only spawn in Silithus. Resonating Crystals that spawn major enemies will appear in Tanaris, Feralas, Thousand Needles, and Barrens.

“This is important to know because we expect there to be an overcrowding issue in Silithus on realms whenever large groups of players all go to Silithus at the same time.”While the negative effects of overcrowding can’t be eliminated, we’re taking several steps to mitigate the worst outcomes.”

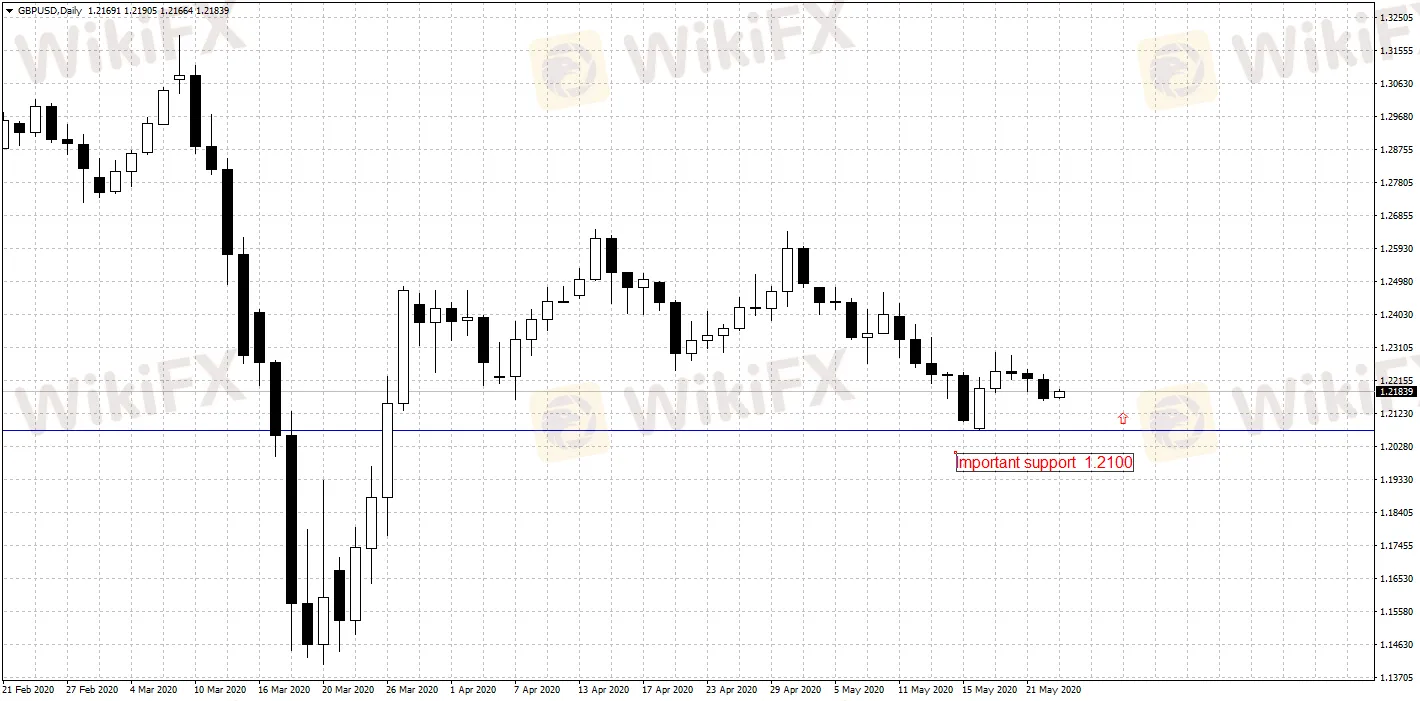

Bank of England Governor Andrew Bailey change his comment last week

that negative rate “is not an approach we‘re considering or planning to

take” and said it’s the right time to review and assess all policy

tools, indicating that the Bank of England is urgently evaluating the

possibility of introducing negative rate.To get more news about WikiFX, you can visit wikifx news official website.

Giving the green light to negative rate doesnt mean the central bank

will immediately adopt a rate below zero. What the central bank is doing

right now is planning for the next step after a potential shock in the

future, and the pandemic accelerated the process. Currently the central

bank is relying on QE as the main stimulus approach, the government has a

rising demand for borrowing, and a risk of further shrinking economy

also confirms the need for easing policies.

With the government launching unprecedented measures to prevent

possible economic breakdown due to the pandemic, Britain‘s budget

deficit in April climbed to an unprecedented high since the modern

record was established in 1993, with central government spending surging

57% and income falling 27%. Even during the financial crisis, Britain’s

monthly borrowing had never exceeded 22 billion pounds.

The price difference between buying and selling is called the spread,

also known as the “bid/ask spread”. The spread is another way to make

money, usually for the brokers who charge “no commission”. Instead of

charging a separate fee for making a trade, the cost is built into the

buy and sell price of the currency pair you want to trade. As

profit-seeking financial institutions. The brokers provide services and

have to make money somehow.To get more news about WikiFX, you can visit wikifx news official website.

In other words, they make money by selling the currency to you for more

than they paid to buy it. And they also make money by buying the

currency from you for less than they will receive when they sell it.

This difference is called the spread.

For example: If you want to

sell your old phone to a second-hand store, in order to make a profit,

the shop owner needs to buy your iPhone at a price lower than the price

he‘ll sell it for. If the phone can be sold for 300 dollars, the owner

can buy it from you for 299 dollars at most in order to make money. That

difference of 1 dollar is the spread. Therefore, if you meet a broker

that claims “zero commissions” or “no commission”, it means there is no

separate commission fee to pay but you still need to pay a commission.

It’s just built into the bid/ask spread!

How is the Spread in Forex Trading Measured?

Pips are used to measure the spread, and a pip is the smallest unit

of the price movement of a currency pair. One pip is equal to 0.0001. An

example is that if you buy a currency pair EUR/USD which is

1.1038/1.1040, you need to paid 2 pips of spread. You need to pay 20

dollars to the broker. It is worth noting that Japanese yen's spread is

only quoted to 2 decimal places, for example, if price of the currency

pair USD/JPY is at 100.00/100.04, the spread is 4 pips.

WikiFX App

is a third-party inquiry platform for company profiles.WikiFX has

collected 17001 forex brokers and 30 regulators and recovered over

300,000,000.00 USD of the victims.

It, possessed by Wiki Co.,

LIMITED that was established in Hong Kong Special Administrative Region

of China, mainly provides basic information inquiry, regulatory license

inquiry, credit evaluation for the listed brokers, platform

identification and other services. At the same time, Wiki has set up

affiliated branches or offices in Hong Kong, Australia, Indonesia,

Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in

more than 14 different languages, offering them an opportunity to fully

appreciate and enjoy the convenience Chinese Internet technology brings.

WikiFXs social media account as below:

Swedish Finance Minister Magdalena Andersson said on Tuesday that her country supports a united response by the EU, but would not back the proposal from Berlin and Paris that would see the bloc tap the bond market for an unprecedented amount of money and distribute that as grants to countries that have suffered economically from the global pandemic.

Read More: Rival Plans for EU Crisis Fund Signal Bumps in the Road to Come

“We also will support some kind of recovery fund but we will have to discuss exactly how it will look like and from our perspective we think it has to be realistic both when it comes to size but also the conditions,” Andersson said in an interview with Bloomberg TV.

Andersson‘s comments come just a day before the European Commission, the EU’s executive arm, unveils its proposal for a recovery package. Her remarks highlight the difficult negotiations the EU‘s 27 governments will have over the coming weeks. Some of Sweden’s fiscally conservative allies in recent days have already shown an openness to compromise that may lay the groundwork for an eventual accord.

Loans vs Grants

The commission‘s proposal will form the basis for discussions between EU governments, though dividing lines have already been drawn. France and Germany want the fund to make grants to countries and sectors most in need, while also saying that their plan wouldn’t lead to the mutualization of debt. Austria, Denmark, the Netherlands and Sweden released their won blueprint over the weekend that would offer loans to countries rather than grants, and would expire after two years.

While EU leaders have agreed on the need for a fund to assist with the recovery, disagreements include its size, whether allocated money would need to be repaid and any conditions tied to the disbursements. While theyve broadly accepted that some of the money will come from jointly-issued EU debt, how much the bloc will raise remains in dispute.

France and Germany threw their weight behind a plan to allow the commission to issue 500 billion euros of bonds, a significant shift for German Chancellor Angela Merkel who has previously resisted French calls to shoulder more of the burden of the European recovery. The proposal would require approval by all 27 EU countries and the European Parliament.

And despite their skepticism, at least some of the four countries most averse to the Franco-German plan have already softened their positions, signaling a compromise may be in the offing.

Austrian Finance Minister Gernot Bluemel said in an interview with Austrian public TV that an agreement could see some of the aid disbursed as grants. Asked if a deal was thinkable in which the majority of the aid would be disbursed as grants, Bluemel told broadcaster ORF: “What we dont want is that it will be only grants, and that this is the start of debt mutualization.”

Still, giving hard-hit countries loans rather than handouts would be more palatable, according to Andersson. It would be “easier to explain to the citizens of Europe if we work with loans rather than grants when it comes to the recovery phase.”

Japan is considering a new round of stimulus scheme worth of 100

trillion yen(US$929.45 billion), which includes financial aid programs

for businesses under the shock of coronavirus pandemic.To get more news

about WikiFX, you can visit wikifx news official website.

The scheme will be funded by the second extra budget of the fiscal year starting this April.

According to Nikkei News, this will be the second massive stimulus

kicked off by the Japanese government after the record-breaking US$1.1

trillion spending plan launched last month, which focused on cash

assistance for households and loans to small businesses hit by the

pandemic.

We estimate Japanese governments economic stimulus will drive down the

price of the yen, which has also been reflected in the latest change of

forex market positions. As of May 19th, speculative net longs in JPY

decreased by 467 to 27,470 contracts, with speculative longs dropping

4,269 to 52,038 contracts and speculative shorts down by 3,802 to 24,568

contracts.

Overnight USD/CAD rate dropped 228 pips to 1.3773, a new low since

March 16th . This has been the largest intraday decline since March.

Bank of Canada‘s outgoing Governor Stephen Poloz maintains a dovish

forward guidance before leaving the post, saying that the central bank

is “doing the best to ensure a solid foundation for economic recovery”.

Poloz is leaving the post in June, and he had previously warned that

massive monetary stimulus will be needed for Canada’s economy.

As the Bank of Canada remains open to introducing more unconventional

measures, the Canadian dollar may face even more unfavorable risks.

Canada will release on Friday the GDP for Q1, 2020, which is expected

to see the greatest decline since the data was first recorded and

published in 1961.